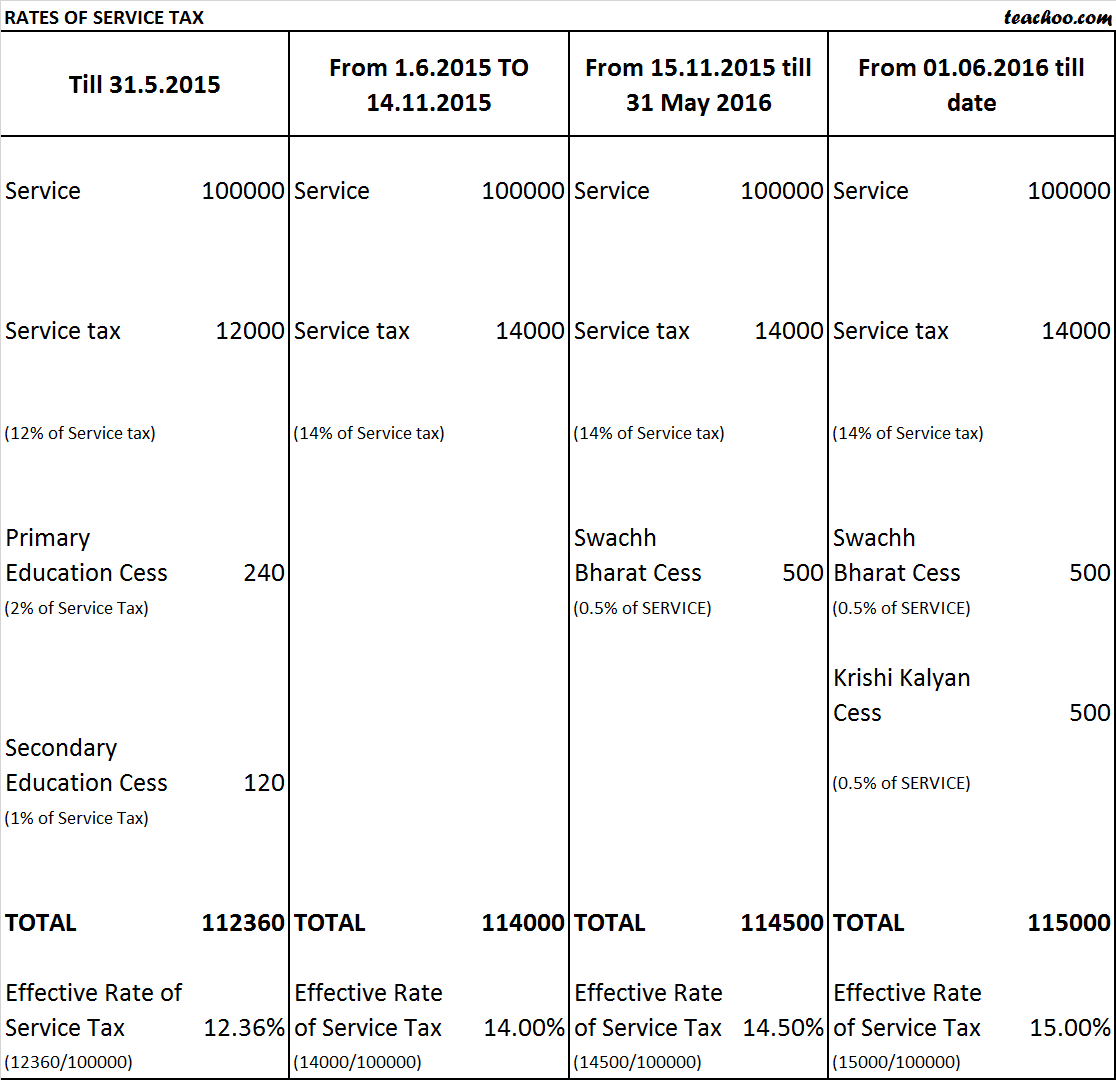

april 2016 service tax rate

01-06-2016 is increased from 1450 to 15 14 ST 050 Swachh Bharat Cess 050 Krishi Kalyan Cess by way of introducing Krishi Kalyan Cess 050 on value of taxable services. Changes in service tax Budget 2016.

However taxable income over certain levels was subject to a 33-percent tax rate to phase out the benefit of the 15-percent tax bracket as compared to the 28-percent rate and the deduction for personal exemptions.

. 20 of 2015 the Central Government hereby appoints the 1st day of April 2016 as the date on which the provisions of sub-section 1 of section 109 of the said Act shall come into effect. 8 rows April 2016-Sep 2016 April-May 145 July-Sep-15 Oct 2016-March 2017 Oct-March 15. Some 9 million tourists visit the French Quarter annually.

Changes in Abatements wef. 142016 vide Notification 82016-ST dated 01. Hitherto this service was covered under clause o of section 66D Negative List which stands omitted by the Finance Act 2016 wef.

Cenvat credit on input input services and capital goods are not available. Service tax is only liable to be paid in case the total value of the service provided during the financial year is more than 10 lakh US13000. Tax Rates 2016 1 For Tax Years 1988 through 1990 the tax rate schedules provided only two basic rates.

In case of small service providers whose value of taxable service did not exceed Rs. The Finance Bill 2015 proposes an increase in rate of Service Tax from 1236 to 14. If a new levy is introduced like Krishi Kalyan Cess or a service taxed for first time then Rule 5 is to be referred.

C urrently Service Tax is levied at the rate of 12 vide charging section 66 of the Finance Act 1994 Chapter V However vide Service Tax Notification no. For the tax payers with value of taxable service less than 60 lakh rupees in PFY interest rate for delayed payment will be 12. Service tax rate increased from 145 to.

From the 1st of June 2016 service tax is levied at 15 of the value of taxable services under Section 66 of the Service Tax Act. You may also like to read Chapter V of Finance Act 1994. 132016-ST dated 1-3-2016 effective from 14th May 2016.

28 of 2016 the effective rate of Service Tax wef. Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects. Cenvat credit of input services are now available.

Set out below are the amendments effective from 1 April 2016. 15 percent and 28 percent. New tax rates which take effect on January 1 2016 will be 925 for retail and close to 10 for restaurants.

82009 dated 24-02-2009 the Central Government exempts all the taxable services from so much of service tax leviable there on under section 66 of the Finance Actaudemars piguet replica as is in excess of. However if assessee has collected service tax but did not deposit it with Government interest rate will be 24 Notification No. The estimated 2 million generated by the tax increase will fund additional public safety measures in the French Quarter such as a full-time state trooper presence.

Taxpayers fall into one of seven 2016 tax brackets depending on their taxable income. Service Tax Law Finance Act 1994 Senior Advocates shall. The Education Cess and Secondary and Higher Education Cess shall be subsumed in the revised rate of Service Tax.

The service tax rate may get changed by Budget 2016 from 145 to 16. Services provided by stage carriage shall also be covered under entry 9A and allowed abatement 60 percent wef. 10 15 25 28 33 35 or 396.

18 rows 600. 42 1430 435 14530 45 1530 Effective from 01042016 a uniform abatement at the rate of 70 is prescribed for services of construction of complex building civil structure or a part thereof subject to fulfillment of the existing conditions. The 15 includes 05 Krishi Kalyan Cess and 05 Swach Bharat Cess.

Due Date of Service Tax Return for April to June 2012 has been Extended to 25th. 16 rows Rate of Service tax would eventually increases to 15 wef. In exercise of the powers conferred by section 109 of the Finance Act 2015 No.

Krishi Kalyan Cess is proposed to be levied from 162016 05 on the value of such taxable services. Service Tax Rate. Penal Rate in case of tax collected but not deposited to exchequer.

For the scenario till 31032016. From 142016 service tax is leviable on 30 on amount charged for service of transport of passengers by rail without availability of cenvat credit of inputs and capital goods. After levy of KKC.

60 lakhs during any of the financial years covered by the notice or during the last. Interest rates on delayed payment of dutytax across all indirect taxes is proposed to be made uniform at 15. 01062016 30062017 15 14 Service Tax 050 Swach Bharath Cess 050 Krishi Kalyan Cess Small scale exemption.

Invoices raised on advances before 30th May 2015 for future services could be paid at the old service tax rate of 1236. New Service Tax Chart with Service Tax Rate of 15. New Service Tax Rate effective from 01-06-2016 After enactment of the Finance Act 2016 No.

The Service Tax laws enacted under Chapter V of the Finance Act 1994 have been amended vide Union Budget 2016-17. Important Changes in Service Tax in Budget 2015-2016. The 15 includes 05 Krishi Kalyan Cess and 05 Swach Bharat Cess.

The five states with the highest average combined state and local sales tax rates are Tennessee 946 percent Arkansas 930 percent Louisiana 90 percent Alabama 897 percent and Washington 890 percent. Tax system is a progressive one as income rises. If invoices are raised before June 1st 2016 for services to be provided after June 2016 then the service tax rate applicable is 14.

If Petrol And Diesel Are Brought Under Gst They Ll Have To Be Taxed At More Than 100 Mint

How Is My Tax Collected Low Incomes Tax Reform Group

The Complete Guide To The Uk Tax System Expatica

India National Income Per Capita 2022 Statista

2021 2022 Tax Free Personal Allowance Increase Tax Rebate Services

New State Pension Rates What Is The Full Amount And Was Yours Previously Underpaid

I Am A Scottish Taxpayer What Scottish Income Tax Will I Pay In 2022 23 Low Incomes Tax Reform Group

Image Result For Gst In Other Countries List List Of Countries Country Other Countries

F Y 2016 17 Due Dates Of Service Tax Tds Tcs Central Exxcise Cst Vat Pt Esic Pf Accounting Taxation Tax Payment Tax Due Date

How Much Is Car Tax Going Up In 2022 Vehicle Excise Duty Bands And Rates And How Much It Will Rise In April Nationalworld

Scottish Income Tax Distributional Analysis 2022 2023 Gov Scot

Live News Updates From April 28 Us Economy Contracts For First Time Since Mid 2020 Service Division Stars As Apple Revenues Jump Financial Times

How Much Is Car Tax Going Up In 2022 Vehicle Excise Duty Bands And Rates And How Much It Will Rise In April Nationalworld

Live News Updates From April 28 Us Economy Contracts For First Time Since Mid 2020 Service Division Stars As Apple Revenues Jump Financial Times

Global Tax Deal Reached Among G7 Nations The New York Times

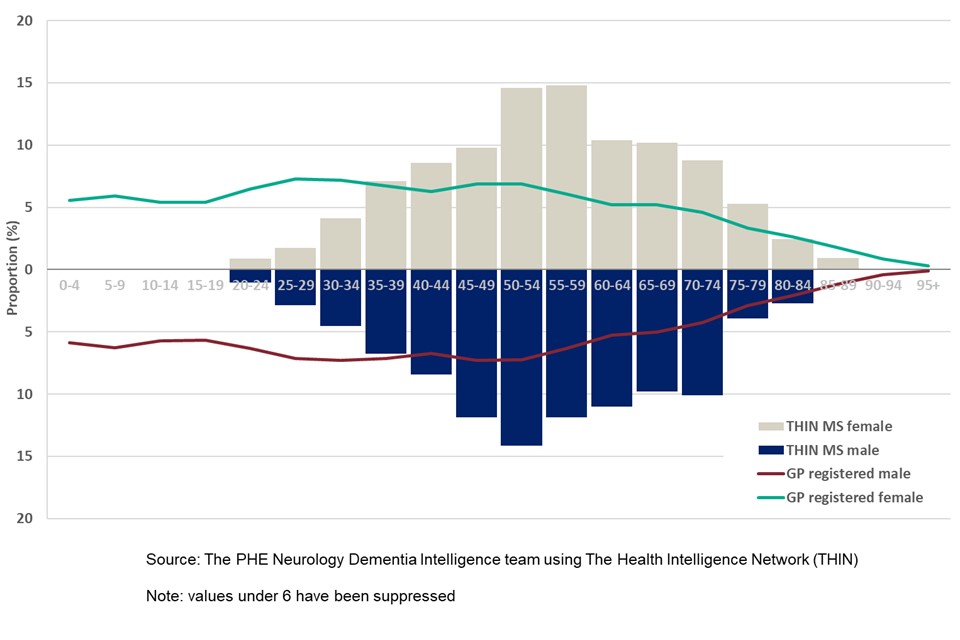

Multiple Sclerosis Prevalence Incidence And Smoking Status Data Briefing Gov Uk

Rescinding Of Notifications Under Certain Sections Of Mvat Http Taxguru In Goods And Service Tax Resc Goods And Services Goods And Service Tax Indirect Tax